This proposal is authored by the Mantle Core Contributor team.

Executive Summary

Authorization for Mantle’s second budget cycle (from July 2024 to June 2025) was approved through MIP-31 in August 2024. Spending under each category has been within the scope of MIP-31. Our focused strategies and operational efficiencies have driven substantial progress in new product expansion and ecosystem growth, reflecting our commitment to excellence.

This report reviews financial performance and highlights achievements during the second budget cycle, and proposes a budget allocation for the third budget cycle (from July 2025 to June 2026).

Key financial and operating highlights during the second budget cycle:

-

Mantle generated $48.86 million in revenue from Mantle Treasury investment and Mantle Network operations;

-

Expenses under each category are within the budget of the second budget cycle;

-

Various products have emerged and scaled in the Mantle ecosystem, such as mETH Protocol, Function FBTC, MI4 Enhanced Index Fund, and UR;

-

The same budget limit is proposed for the third budget cycle as in the second budget cycle.

Proposal

For the third budget cycle (a 12-month period from July 2025 to June 2026), we propose the following budget for consideration and voting.

By voting “Yes”, you endorse the following terms:

-

Limits — The authorized limits for the third budget cycle (a 12-month period from July 2025 to June 2026) shall be set as the same level as the previous budget cycle:

a. Total USDx limit: 52 million units

b. Total MNT limit: 200 million units

Higher limits are proposed to provide flexibility for business expansion, while maintaining an oversight checkpoint from Mantle Governance. Any actual or forecasted spending above the limits requires a subsequent discussion and vote. -

Exclusions — The following items shall not be part of the budget scope and limits:

a. Financing activities (e.g., node delegation, working capital loans if any): Loan receivables will be returned or settled, and are not considered expenses.

b. Gas costs: Gas costs related to Protocols (e.g., L1 commitment gas costs, LSP node gas transactions, and ad hoc deployment expenses) shall not be part of the budget limits, as these costs are unavoidable, and will be tracked on Treasury Monitor.

c. Other non USDx/MNT spending: ETH/mETH/ENA or other ecosystem partner tokens may be used for various ecosystem incentives. Such programs, if any, are public and are subject to community oversight. -

Budget Cycle

a. All annual budgets and limits shall be extended pro-rata for up to 3 months of the following budget cycle to allow for subsequent budget to be proposed, discussed, and approved.

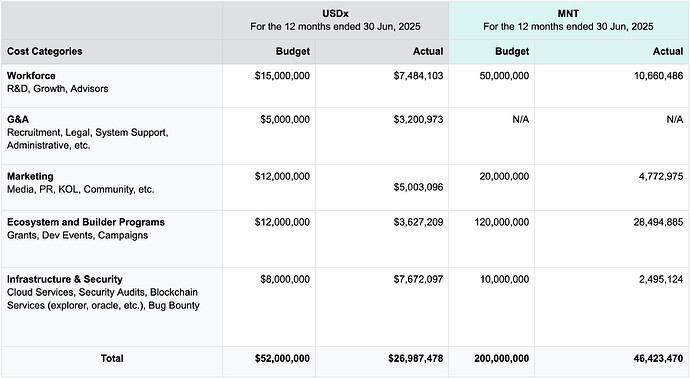

Review of Budget vs Actual Cost in The Second Budget Cycle

Revenue

During the second budget cycle (from July 2024 to June 2025), Mantle’s revenue streams were diversified across treasury investment and Mantle Network gas income:

-

Treasury investment: $3 million equivalent in USDT/USDC, $19.3 million equivalent in ETH, $12.6 million equivalent in ENA, and $12.2 million in other investment, valued at the monthly closing price as of the month of realization.

-

Mantle Network sequencer revenue: $1.76 million

Expenses

Mantle managed to exercise prudent discipline as actual expenditures were kept within the limits of the allocated budget under each category.

Provisional Budget Limit for The Third Budget Cycle

(July 2025 – June 2026)

The same total budget limit as the second budget cycle is proposed for the third budget cycle.

The USDx budget limit for workforce decreases by 2 million, while the USDx budget limit for infrastructure & security increases by 2 million.

Higher limits are proposed to provide flexibility for business expansion while maintaining an oversight checkpoint from Mantle Governance. Actual spend will likely be well below limits.

Achievement Across Mantle Ecosystem in The Second Budget Cycle

The fiscal year ending June 30, 2025, has been a period of significant growth and operational success for Mantle. We have fostered strategic partnerships, engaged globally with the community, and saw substantial ecosystem growth, all while adhering to approved budgetary limits.

-

Blockchain reliability: Mantle Network maintained a 100% uptime record

-

Architecture upgrade: Finalizing the upgrade from an Optimistic Rollup to a zkEVM in Q3 2025 in collaboration with the Succinct team, reducing withdrawal times from 7 days to hours and enhancing scalability while maintaining EVM compatibility

-

EigenDA migration: Completed a major infrastructure migration to EigenDA, significantly improving data availability and scalability while lowering network latency and gas costs for users

-

Ecosystem growth: Grew TVL to over $2 billion, driven by strategic partnerships and successful growth initiatives, including a focused expansion into the LATAM market

Highlight of Selected Ecosystem Projects

mETH Protocol

mETH Protocol, an Ethereum liquid staking protocol, continued to deliver results across its core protocol, DeFi vertical and institutional partnerships.

-

Strong performance & TVL: mETH and its restaked counterpart, cmETH, have achieved peak total TVL of $1.86 billion (464K mETH) and $792 million (227K cmETH), respectively during the second budget cycle. On Mantle Network, it has achieved peak TVL of $471 million (111K mETH) and $467 million (134K cmETH)

-

Competitive restaking yields: Liquid restaking token cmETH offers market-leading returns, including a base staking reward of ~3% APY and ~5% APY for deposits in the cmETH Fixed Yield Vault

-

Tier-1 exchange listings: Expanded accessibility by enabling staking and unstaking directly from major centralized exchanges, including Bybit and Kraken

-

Pioneering institutional adoption: Forged a landmark partnership with Republic Technologies (Ethereum treasury for publicly-listed Beyond Medical Technologies, CSE: DOCT), making mETH the first liquid staking token held on a public company’s balance sheet

-

DAO treasury integration: Solidified mETH’s role in treasury diversification through a key partnership with NounsDAO, one of Ethereum’s most active DAOs

Function FBTC

Function is a curated platform for BTC yield, focusing on building the most secure infrastructure for institutions, retail platforms, and builders to access curated strategies. It does this via its flagship asset, FBTC, a hyper-liquid and composable Bitcoin asset that integrates seamlessly into onchain lending, structured yield products, and institutional-grade financial systems.

-

Increased market adoption & growth: since its launch in Q3 2024, FBTC has reached a peak TVL of $1.6bn (~15k BTC) and is now available across 10 chains and over 30 defi protocols

-

Deepened defi integration & utility: a key integration with Aave unlocked FBTC’s utility across EVM protocols and lowered the cost of capital for yield strategies

-

Strengthened Cefi integration & scale: launched a successful BTC Earn program with Bybit at 2% yield

UR

UR has been developing a fully onchain crypto smart money app, a first of its kind for the category.

-

dApp launch: the dApp was launched in June 2025 with core functions, including i) Swiss IBAN; ii) Mastercard debit card; iii) crypto-to-fiat conversions; and iv) FX across 4 currencies (EUR, CHF, RMB and USD)

-

Mantle Network settlement: Integrated core UR infrastructure, with all fund transfers, FX transactions, and card spending settling directly on Mantle Network

MI4

The Mantle Index Fund (MI4) is Mantle’s first traditional finance asset management product that launched in April 2025. The MI4 index fund product comprises a basket of yield-generating BTC, ETH, SOL and USD stablecoins with automatic rebalancing, providing a streamlined way for investors to access crypto beta.

-

Peak AUM from launch to June 30, 2025: $185 million

-

Absolute return from launch to June 30, 2025: 30%

-

Tokenization & distribution: The MI4 fund is tokenized and settled on Mantle Network. It is accessible for investors through Securitize and is currently the largest tokenised fund on-chain

Review by Category

Mantle’s expenditures were strategically allocated to support growth initiatives while maintaining fiscal responsibility.

Category: Workforce

-

Budget limit in the second budget cycle: 15 million USDx + 50 million MNT

-

Actual spend in the second budget cycle: 7.48 million USDx + 10.66 million MNT

-

Budget limit in the third budget cycle: 13 million USDx + 50 million MNT

-

Mantle’s core team has streamlined from 83 to 72 full time contributors as we developed a more focused strategy.

-

The major workforce growth was that we have added 4 security engineers.

Category: General & Administrative

-

Budget limit in the second budget cycle: 5 million USDx

-

Actual spend in the second budget cycle: 3.2 million USDx

-

Budget limit in the third budget cycle: 5 million USDx

-

Mantle uses various professional service providers for recruitment services, legal advisory, finance support, etc. These services account for 55% of expenses. Other G&A expenses include rent, travel, system subscriptions and miscellaneous costs.

Category: Marketing

-

Budget limit in the second budget cycle: 12 million USDx + 20 million MNT

-

Actual spend in the second budget cycle: 5 million USDx + 4.77 million MNT

-

Budget limit in the third budget cycle: 12 million USDx + 20 million MNT

-

Mantle has collaborated with leading marketing agencies, partners, and research entities to strengthen its visibility across the global crypto community. Coverage from reputable media and research institutions — including Bankless, Blockworks, Unchained Podcast, Delphi Digital, and Messari — as well as influential thought leaders, has helped amplify Mantle’s reach.

-

Over the past year, Mantle has also expanded into traditional finance media, with features in legacy outlets such as the Financial Times and Bloomberg.

-

Mantle’s Twitter following has grown to over 800K, while “smart followers” — a measure of highly engaged and influential accounts — increased by 25% this year to 2.2K. Net positive sentiment is now at 71%, up 16% year-on-year.

-

The Telegram and Discord communities remain active, with more than 40K members engaging in discussions, AMA sessions, and project updates. More than 120 AMAs have been hosted across official and ecosystem channels, featuring thought leaders and project teams. Signature series such as Mantle Ecowaves, Mantle Showcase Radio, Ecosystem-Community Deep Dives, Quarterly Livestreams, and DeFi Uncovered have been instrumental in driving engagement and adoption.

-

Mantle has maintained a strong global presence, participating in 50+ events, including Blockworks DAS NYC and London, EthCC, TOKEN2049 Singapore, and major blockchain weeks worldwide. Additionally, community-led Mantle Meetups energized regional communities worldwide, bringing thousands together across five continents in 2025.

Category: Ecosystem & Builder Programs

-

Budget limit in the second budget cycle: 12 million USDx + 120 million MNT

-

Actual spend in the second budget cycle: 3.63 million USDx + 28.49 million MNT

-

Budget limit in the third budget cycle: 12 million USDx + 120 million MNT

-

Capital Formation & Liquidity Growth: Mantle Network currently secures $2.18 billion in total value, reflecting confidence from both users and institutional partners. Mantle has also reached a $722 million stablecoin supply, demonstrating its role as a robust liquidity hub.

-

Onchain & Permissionless Finance: Over 54.6% of network transaction activity is DeFi-related, a testament to Mantle’s focus on on-chain finance and banking. Led by key DeFi dApps such as Merchant Moe, AGNI, INIT Capital, Lendle, Compound, Ethena, Pendle and Treehouse, Mantle Network boasts a thriving financial ecosystem enabling democratized access to all.

-

User Adoption & Retention: The network now boasts over 1.5 million monthly active addresses, a testament to Mantle’s ability to attract and retain a growing user base amidst a competitive L2 landscape.

-

Ecosystem Expansion: More than 300 dApps have been deployed on Mantle, broadening the utility and use cases available to users across DeFi, gaming, NFTs, and infrastructure. Over 407,000 smart contracts have been deployed, showcasing developer activity, experimentation, and sustained innovation across the network.

-

Developer Activations: Mantle has supported 30 hackathons globally, fueling grassroots innovation and onboarding new developers into the ecosystem. With 8 Sozu Haus activations, Mantle has extended its cultural and community footprint, deepening its connection with builders, creators, and partners.

-

Grants to ecosystem projects account for 50% of USDx spent. The rest is used for various event activations.

-

Grants to ecosystem projects account for 60% of MNT spent. The rest is used for community activation together with ecosystem projects, exchange partners, sponsorship, and bounty programs, etc.

Category: Infrastructure & Security

-

Budget limit in the second budget cycle: 8 million USDx + 10 million MNT

-

Actual spend in the second budget cycle: 7.67 million USDx + 2.5 million MNT

-

Budget limit in the third budget cycle: 10 million USDx + 10 million MNT

-

Cloud service, security audits and blockchain infrastructure providers (explorers, oracles, third party RPC, indexer, etc.) are major expense categories.

-

As Mantle Network is expecting major upgrades to transform into a zk rollup, costs of security audit, zk proof and support services may further increase. We’d propose a higher provisional budget limit.

Conclusion

Mantle has demonstrated strong financial discipline and operational excellence in the second budget cycle, enabling transformative growth and innovation. In the new budget cycle, the focus remains on scalable expansion, ecosystem development, and maintaining fiscal accountability.